To request money, follow the same steps as mentioned above, except, this time, select “Request.” Go into your Chase mobile app: Here’s a 30-second video that shows you how seamless the process is.

#CHASE ZELLE QUICKPAY DOWNLOAD#

They just have to download the Zelle app on any mobile device. If their bank doesn’t work with Zelle, you can still send and receive money with them.

#CHASE ZELLE QUICKPAY FULL#

Check out the full list of participating banks here.

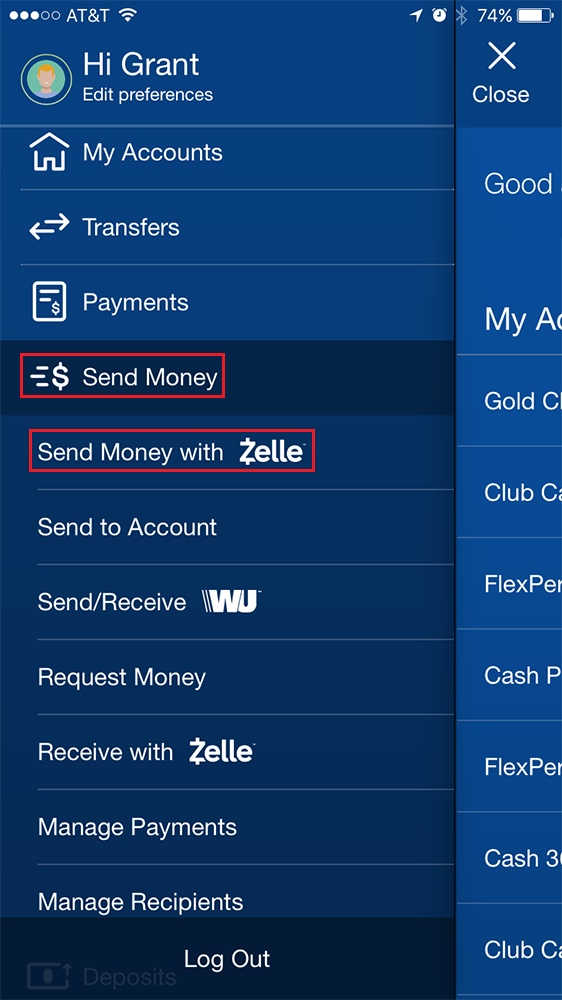

Note: Not all bank accounts work with Zelle. If their bank doesn’t support real-time payments, it can take between 1-2 business days for the money transfer to go through. That’s especially key if you’re sending or receiving money with someone you don’t fully trust. If your friend has a Chase account or a bank account that works with Zelle and supports real-time payments, then they’ll receive the money within a few minutes. Bank, Bank of America, Wells Fargo, and Citi, as well as many regional banks, work directly with Zelle. Many large banks, such as Capital One, U.S. You can send or receive money from your Chase checking account or from a Chase Liquid card to anyone with a participating bank account. Here’s the best part, you can send them money whether they have a Chase bank account or not.

You’ll receive a confirmation with a satisfying green check.

With PayPal, you have to pay a fee for the money to show up right away otherwise, it arrives in your checking account the next business day. The main thing that sets QuickPay apart is the money transfers within a few minutes as long as their bank participates in real-time payments. You just quickly and safely send and receive money.īut that’s just personal preference. Why Should You Use Chase QuickPay?įor one, the user interface is more streamlined than Paypal, and it’s not trying to be a new social media account like Venmo. If you are a Chase customer but haven’t downloaded the Chase mobile app, it’s probably time to start asking yourself some tough questions.

0 kommentar(er)

0 kommentar(er)